Major Financial Data

*The THK Group decided to adopt IFRS beginning with the 2019 fiscal year.

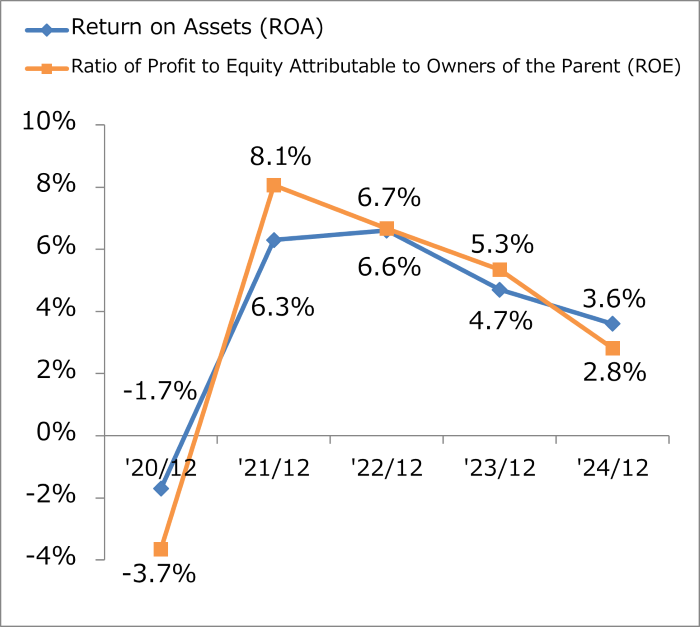

ROA, ROE

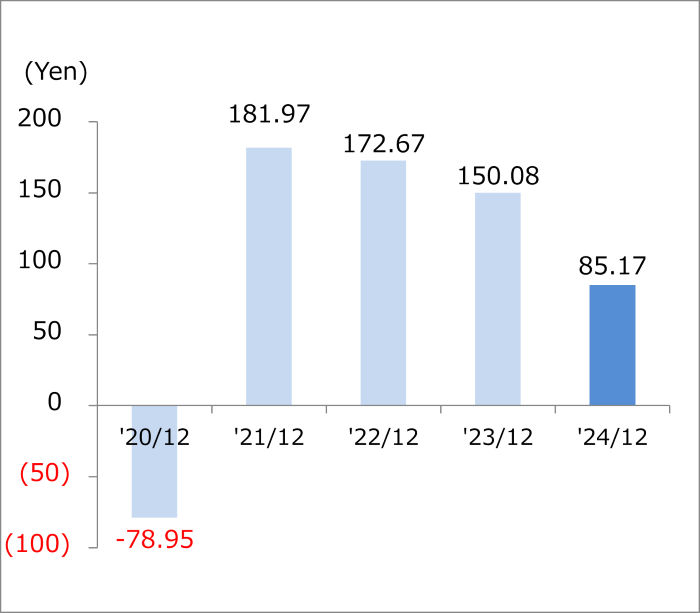

Earnings per Share

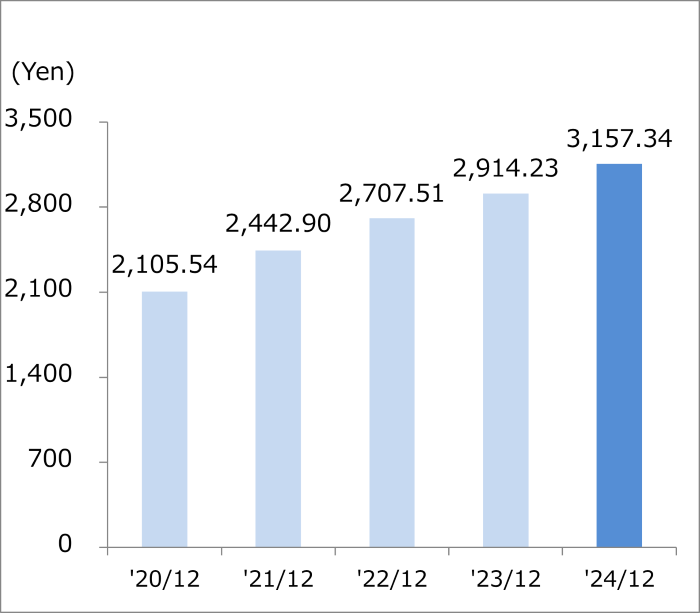

Equity Attributable to Owners of the Parent per Share

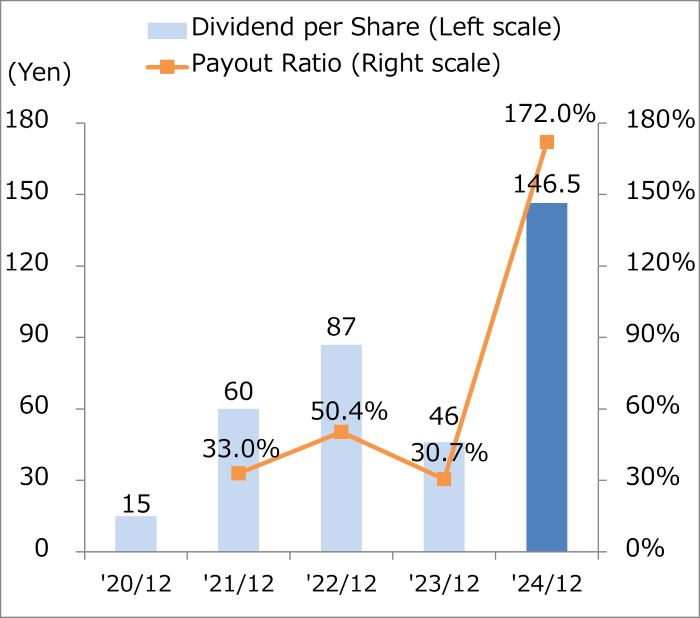

Dividend per Share, Payout Ratio

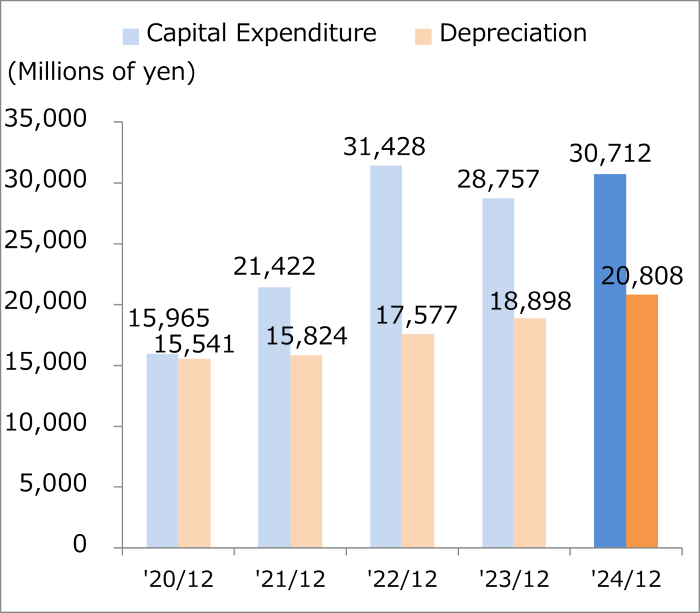

Capital Expenditure, Depreciation

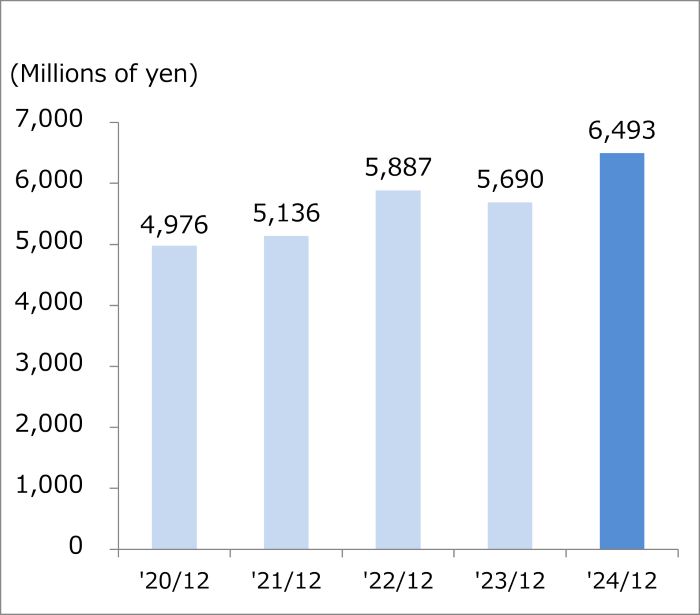

R&D Expenses

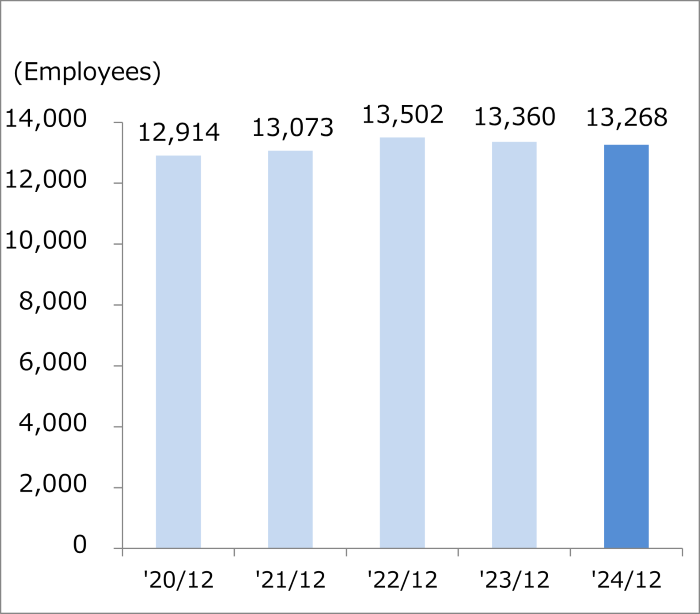

Number of Employees at End of Periods

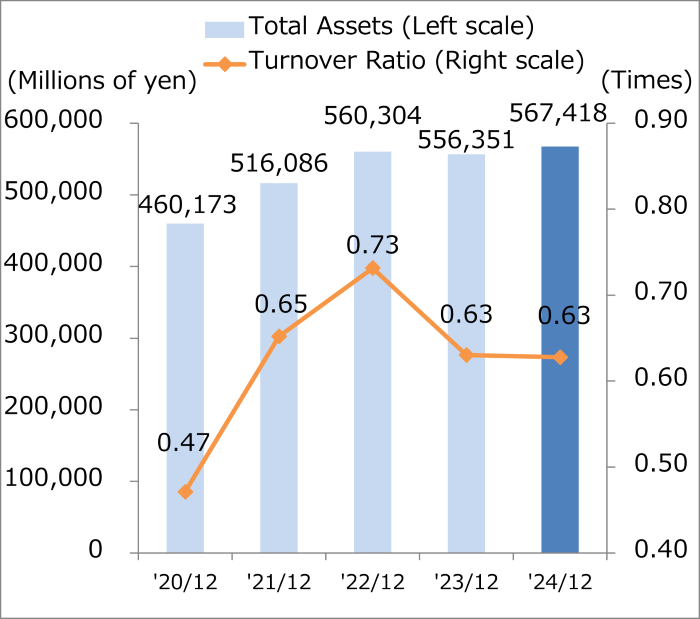

Total Assets, Turnover Ratio

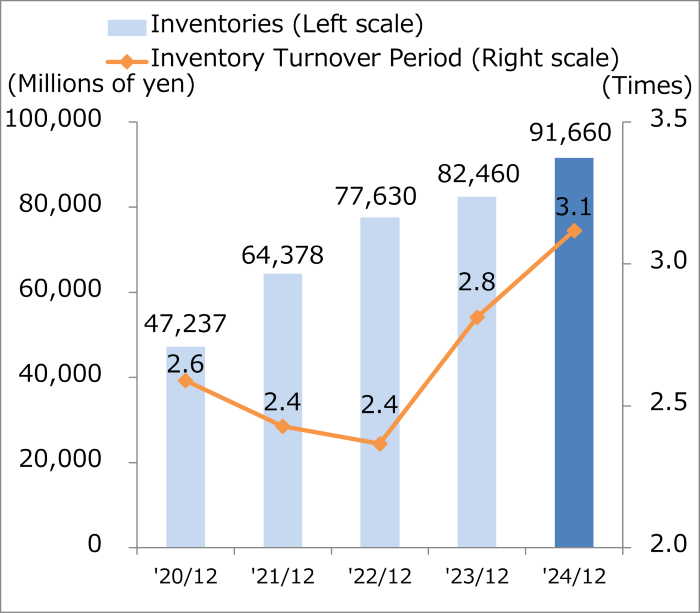

Inventory, Inventory Turnover Period (Months)

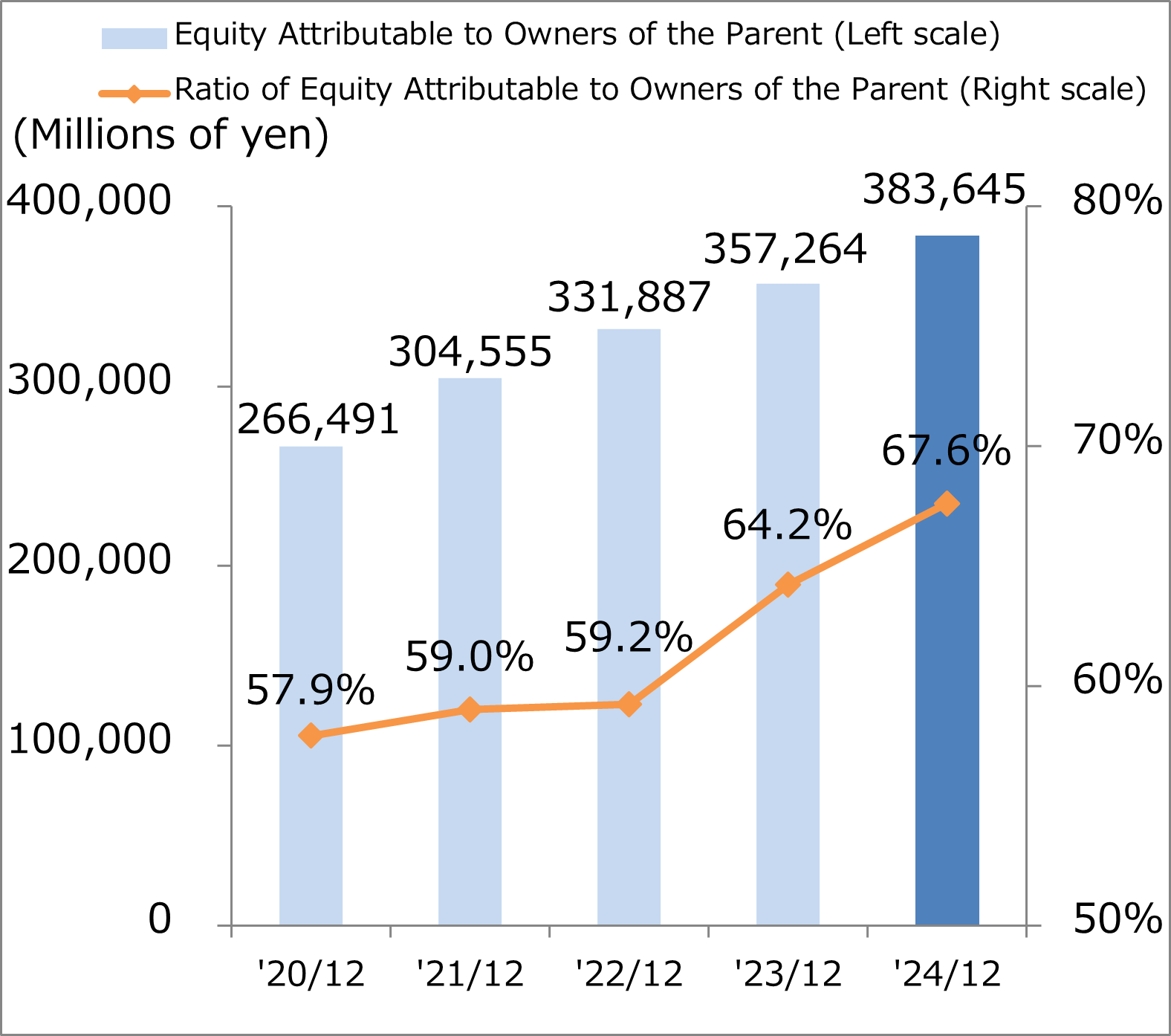

Ratio of Equity Attributable to Owners of the Parent

|

'20/12 |

'21/12 |

'22/12 |

'23/12 |

'24/12 |

|

|

Return on Assets (ROA) |

|

6.3% |

6.6% |

4.7% |

3.6% |

|---|---|---|---|---|---|

|

Ratio of Profit to Equity Attributable to Owners of the Parent (ROE) |

|

8.1% |

6.7% |

5.3% |

2.8% |

|

Earnings per Share |

|

181.97 |

172.67 |

150.08 |

85.17 |

|

Equity Attributable to Owners of the Parent per Share |

2,105.54 |

2,442.90 |

2,707.51 |

2,914.23 |

3,157.34 |

|

Dividend per Share |

15 |

60 |

87 |

46 |

146.5 |

|

Payout Ratio |

- |

33.0% |

50.4% |

30.7% |

172.0% |

|

Capital Expenditure |

15,965 |

21,422 |

31,428 |

28,757 |

30,712 |

|

Depreciation |

15,541 |

15,824 |

17,577 |

18,898 |

20,808 |

|

R&D Expenses |

4,976 |

5,136 |

5,887 |

5,690 |

6,493 |

|

Number of Employees at End of Periods |

12,914 |

13,073 |

13,502 |

13,360 |

13,268 |

|

Turnover Ratio |

0.47 |

0.65 |

0.73 |

0.63 |

0.63 |

|

Inventory Turnover Period (Months) |

2.6 |

2.4 |

2.4 |

2.8 |

3.1 |

|

Ratio of Equity Attributable to Owners of the Parent |

57.9% |

59.0% |

59.2% |

64.2% |

67.6% |