Management Capital and Strengths

Strengthening Capital Cultivated since Our Founding

We strive to bolster our business foundation through effective use of various forms of capital cultivated since our founding.

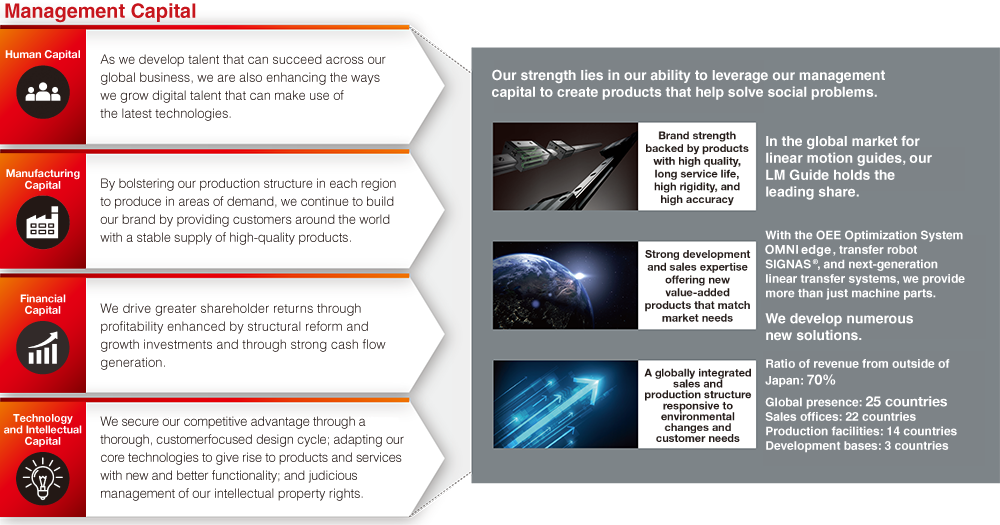

Human Capital As we develop talent that can succeed across our global business, we are also enhancing the ways we grow digital talent that can make use of the latest technologies.

Human Capital As we develop talent that can succeed across our global business, we are also enhancing the ways we grow digital talent that can make use of the latest technologies.

Features of

THK's capital

Supporting

data

- Participants in the international trainee system: 3

- English lesson participants: 119

- See our website for information on digital talent training participation

- Started the “Do-it!” initiative

- Talent hired from outside of Japan: 3

Challenges to

overcome

- Empowering women and promoting diversity throughout the company

- Developing the next generation of management

- Implementation of diverse working styles

- Maintenance and promotion of employee health

Responses to

these challenges (measures being taken)

- Diversity training throughout the company

- Expansion of training to develop the next generation of management

- Establishing remote work and flexible shift systems

- Initiatives for health management

In order to achieve an ROE greater than 10% as quickly as possible in our transformation into a manufacturing and innovative services company, it is essential that each and every employee faces their work with a goal-oriented mindset to create added value. As a foundation to accomplish this, it is absolutely critical to provide our employees with flexible ways to work, improve work-life balance, create an environment and culture that respects diversity, and strengthen the relationship of trust between employees.

Furthermore, as we continue to maintain a stable working environment for our employees, it is important that we maintain and improve both their mental and physical health. In addition to these initiatives, THK is striving to develop global talent, digital talent, and the next generation of management.

Manufacturing

Manufacturing

Capital By bolstering our production structure in each region to produce in areas of demand, we continue to build our brand by providing customers around the world with a stable supply of high-quality products.

Capital By bolstering our production structure in each region to produce in areas of demand, we continue to build our brand by providing customers around the world with a stable supply of high-quality products.

Features of

THK's capital

Supporting

data

- Capital investments: ¥30.7 billion

- Production facilities: 37

13 in Japan, 6 in the Americas, 4 in Europe, 6 in China, 8 in Asia and other regions

Challenges to

overcome

- Increasing productivity per person

- Workforce development (DX, operation of robots and automated equipment, and application of technical knowledge to production)

Responses to

these challenges (measures being taken)

- Establishing a 24-hour production structure through the installation of automated equipment

- Data utilization training and on-the-job training

In order to achieve an ROE greater than 10% as quickly as possible, it is crucial that we work to increase productivity per person by efficiently maximizing utilization of our automated equipment. For this reason, we are installing robots and automated equipment to extend unmanned operating time and, ultimately, to realize a 24-hour production structure with fewer people. Furthermore, in addition to having employees actively participate in external trainings to learn how to use new equipment effectively, we are also promoting innovation in the 5 M's of our manufacturing process (Man, Machine, Method, Material, and Measurement) and driving sustainable improvements to product quality and productivity through a variety of DX activities made possible by the Smart Factory project currently being rolled out on our production floors.

Financial Capital We drive greater shareholder returns through profitability enhanced by structural reform and growth investments and through strong cash flow generation.

Financial Capital We drive greater shareholder returns through profitability enhanced by structural reform and growth investments and through strong cash flow generation.

Features of

THK's capital

Supporting

data

- Equity capital ratio: 67.6%

- Sales cash flow: ¥28.4 billion

- Current cash: ¥138.2 billion

- Payout ratio: 172.0%

Challenges to

overcome

- ROE stagnation (2.8% in 2024)

- Promotion of management that emphasizes profitability and capital efficiency

- Continuing to provide appropriate shareholder returns consistent with appropriate levels of shareholders' equity

Responses to

these challenges (measures being taken)

- Structural reform of the industrial machinery business

- Successful execution of a strategy of selection and concentration for the automotive and transportation business

- Implementation of an 8% dividend on equity ratio (DOE) (until an ROE greater than 10% is achieved)

- ¥40 billion purchase of treasury stocks

(from December 2024 to March 2025)

THK has reviewed its entire suite of capital policies with the aim of achieving an ROE greater than 10% as quickly as possible. With the immediate requirement for equity capital, the denominator of ROE, set at approximately ¥300 billion, we have adopted a dividend on equity ratio (DOE) of 8% and are working to reduce equity capital by purchasing ¥40 billion of treasury stock. For the numerator of the ROE equation, profit, we will drive wholesale structural reform while allocating generated profits towards strengthening competitiveness and investments in our growth. In these ways, we will not only achieve an ROE greater than 10%, but push beyond that point to raise our ROE beyond our capital stock costs for the sake of increasing corporate value to ensure that we can continue to provide stable returns to our shareholders.

Technology and

Technology and

Intellectual

Capital We secure our competitive advantage through a thorough, customer-focused design cycle; adapting our core technologies to give rise to products and services with new and better functionality; and judicious management of our intellectual property rights.

Intellectual

Capital We secure our competitive advantage through a thorough, customer-focused design cycle; adapting our core technologies to give rise to products and services with new and better functionality; and judicious management of our intellectual property rights.

Features of

THK's capital

Supporting

data

- R&D expenses: ¥6.4 billion

- Intellectual property holdings (entire THK Group): Registered: 2,471, Published: 440

- R&D facilities: 3 (1 in Japan, 1 in Europe, 1 in China)

Challenges to

overcome

- Price competition with similar products in emerging countries

Responses to

these challenges (measures being taken)

- Further cultivating our core technology of rolling machine components and developing new products

- Developing services to visualize component status based on extensive performance data

As price competition with similar products intensifies, THK may be forced to go toe-to-toe with companies making products that may or may not be reliable. In anticipation of this, we are working to establish test- and research-based evidence of the reliability of THK products and, as a manufacturing and innovative services company, making further advances with the technical services we offer as well as with the quality of our products.