Business Strategy

Our Business

The main products of our industrial machinery business are high-precision positioning linear motion products such as the LM Guide, ball screws, and ball splines in addition to cross-roller rings, which are a rotary component. We also deal in actuators and modular products that combine machine components. These products have been adopted for use in a wide variety of mechanical devices, including semiconductor manufacturing equipment, machine tools, industrial robots, 3D printers, automated warehouses, robotic surgical systems, high-speed railways, aircraft, and both solar and wind power generation equipment. As for our organizational structure, we possess manufacturing facilities

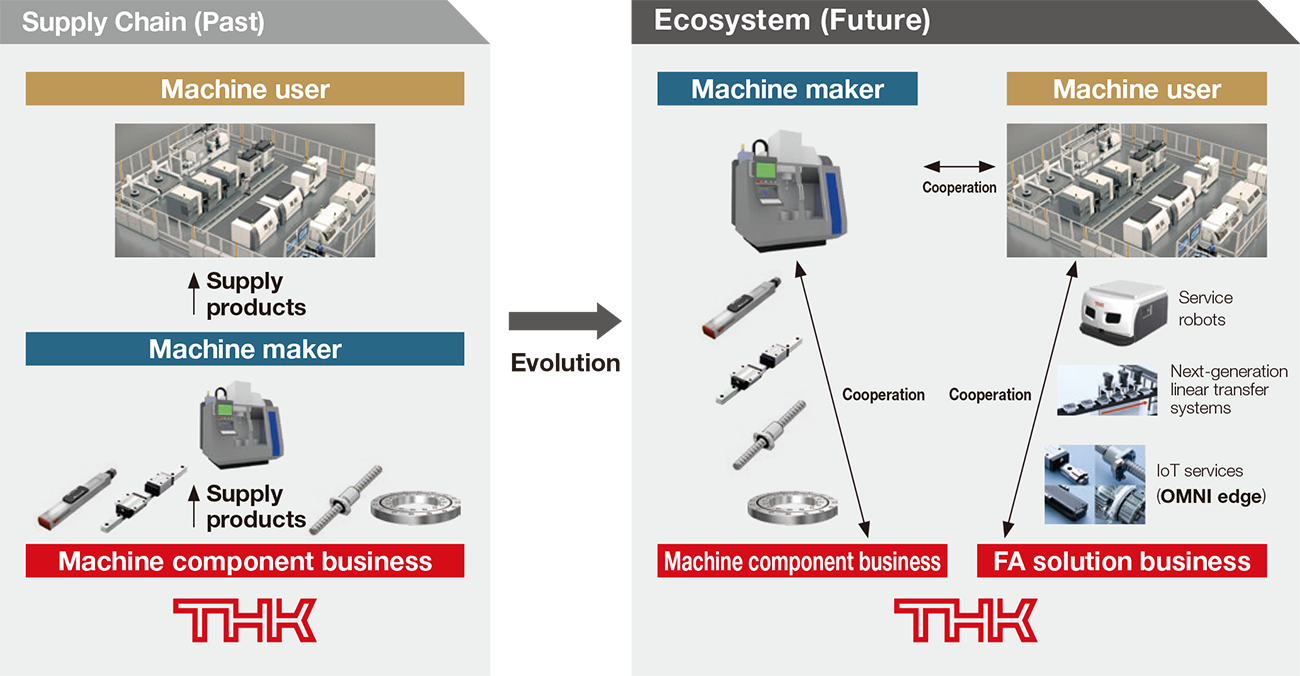

in Japan, Europe, the Americas, South Korea, China, Vietnam, and India to provide a sales support framework that spans the globe. As AI, robotics, and other digital technologies progress and major countries face labor shortages, we anticipate a need for automation and labor savings in many fields that will drive expanded demand for our main products. Furthermore, we have also expanded our OEE (overall equipment effectiveness) optimization system  and begun selling service robots such as our tape-free AGV, SIGNAS. By adding an FA solution business to our existing machine component business, we aim to establish a structure that allows us to support the manufacturing

operations of a variety of customers, from machine makers to machine users.

and begun selling service robots such as our tape-free AGV, SIGNAS. By adding an FA solution business to our existing machine component business, we aim to establish a structure that allows us to support the manufacturing

operations of a variety of customers, from machine makers to machine users.

Reflecting on the 2023 Fiscal Year

With regard to our 2026 management targets, bolstered by the increase in semiconductor-related demand, the advancement of automation and robotization, and the expansion of electric vehicles and other environmental investments, we aim to utilize AI, the IoT, and robot technology alongside the machine component technology we have honed since our founding in order to fortify our position as a company that supports growing fields and to achieve a revenue of ¥365 billion and an operating income of ¥92 billion.

Facing low general demand related to semiconductors and robots in 2023, we were able to achieve revenue in the first half of the year thanks to a high volume of previously received orders. However, as demand failed to recover in the second half of the year, we ended up with a decrease in both revenue and profit, with consolidated revenue standing at ¥217.5 billion (a 22.9% decrease year on year) and operating income at ¥22.2 billion (a 56.6% decrease year on year). In terms of profitability, we were aided by continued improvements in variable and fixed costs in addition to a favorable exchange rate, but the volume effect of our reduced revenue had a negative impact that resulted in a significant decrease in profit. In addition to the continued short-term ebb and flow of capital equipment demand, we anticipate that

the economic environment will grow increasingly uncertain due to the rise of economic blocs and labor shortages. In response, our industrial machinery business will work toward strengthening QCDS under the slogan of glocalization (combining global and local elements).

First, in terms of R&D, we have released an LM Guide with eight raceways that comes in sizes that conform to global standard dimensions and can accommodate nanometer-level movement accuracy in order to provide the high precision, high rigidity, and compact dimensions required for semiconductors and other fields. Additionally, we offer a miniature LM Guide that helps boost production capacity for semiconductor chips. For the automation of transfer and logistics-related processes, we have also introduced wheel guides and utility slides to the market.

In terms of production, we have steadily expanded our ability to provide products and strengthened our cost competitiveness at all of our factories through automation and in-house sourcing. As for sales, we have opened our third ASEAN-region sales office in Vietnam to bolster our ability to take care of customers in this region where demand is expected to rise in the future. We also revised our internal structure to be able to take even more meticulous care of customers who are expanding their design and manufacturing operations worldwide. In this way, we have strengthened the ability of our machine component business to introduce new offerings to growing markets and to tailor our provision of products to demand fluctuations, and we have bolstered our structure to be able to increase our share in overseas markets as well as the Japanese market. Furthermore, we have put effort into developing our IoT services and service robots to expand contact with a diverse range of customers. We released our fourth iteration of  , the Skill Management AI Solution, which centralizes the management of production employee skill data and dramatically boosts the efficiency of skill management. In addition, we have expanded our lineup with a new SIGNAS product that has a one-ton towing capacity and released a next-generation linear transfer system for material handling automation. For these products, we have placed emphasis on selling to machine users. Increasing the diversity of our customer base and selling to both users and manufacturers allows us to understand market trends better than with our traditional machine component business, and we expect that it will

mitigate profit impact caused by economic fluctuations, which will strengthen our business foundation over the long term.

, the Skill Management AI Solution, which centralizes the management of production employee skill data and dramatically boosts the efficiency of skill management. In addition, we have expanded our lineup with a new SIGNAS product that has a one-ton towing capacity and released a next-generation linear transfer system for material handling automation. For these products, we have placed emphasis on selling to machine users. Increasing the diversity of our customer base and selling to both users and manufacturers allows us to understand market trends better than with our traditional machine component business, and we expect that it will

mitigate profit impact caused by economic fluctuations, which will strengthen our business foundation over the long term.

Future Business Developments

Since our founding, we have polished our LM Guide technology, which was a development that significantly reduced friction resistance by replacing traditional sliding motion with rolling motion. We will continue to conduct R&D and improve our product performance as a means to help reduce the energy consumption of customer equipment. In addition to reducing the energy used by production processes at our factories, we aim to reduce CO2 by utilizing renewable energy. In 2023, we installed solar panels at four production facilities: the Yamagata plant, THK NIIGATA, THK Liaoning, and THK RHYTHM Thailand.

Even as we seek to introduce products in demand by growing markets, improve our ability to supply such products, strengthen our cost competitiveness, and expand profitability within our machine component business, we will also focus on developing applications in new fields such as the space industry. At the same time, for our FA solution division, we will focus on expanding our business while contributing to the DX (digital transformation) and GX (green transformation) efforts of our customers. Furthermore, through the synergy of our machine component and FA solution businesses, we will establish an ecosystem that is unique to THK.

Within the industrial machinery business, all of our staff will work with vigor as we delve deeper into full-scale globalization, the development of new business areas, and a change in business style. We will construct a framework to continuously provide reliable products and services to both machine makers and users around the world, and in doing so, we will transform into a manufacturing and innovative services company. In addition, we will contribute to the creation of an affluent society while valuing people and the global environment.

Our Business and Strategy

The Automotive & Transportation Headquarters is largely split into the following three business areas.

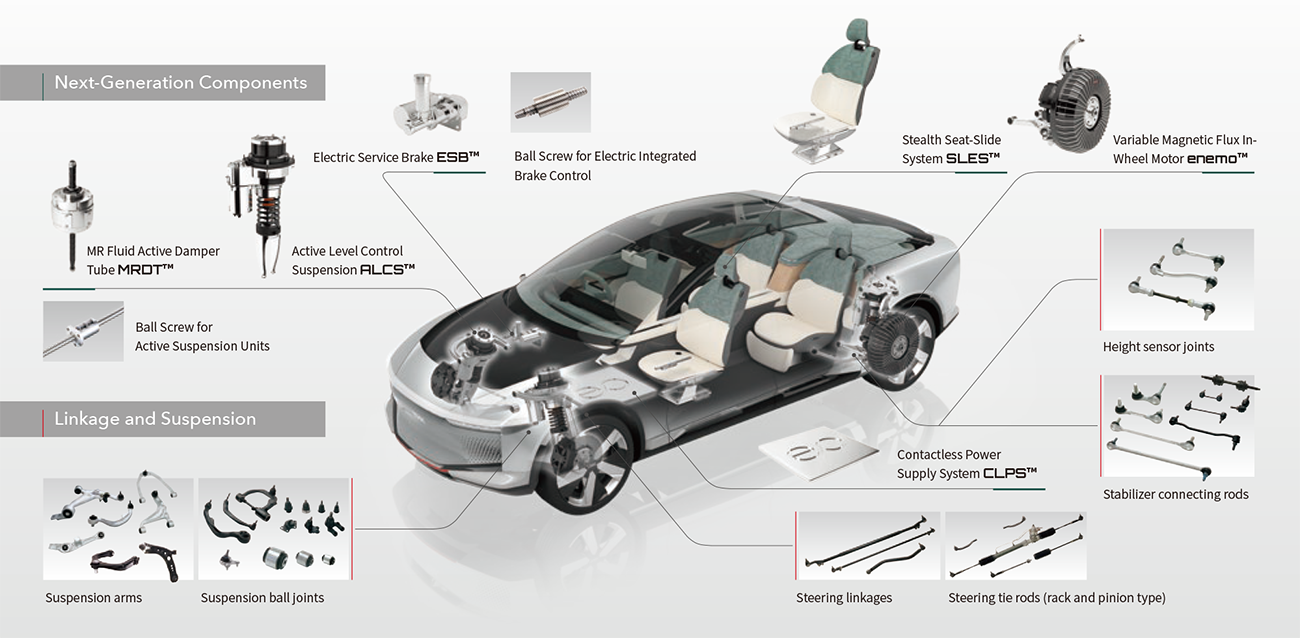

- Development, Manufacture, and Sale of L&S (Linkage and Suspension) Parts

We create original designs for suspension links, ball joints, tie rod ends, and stabilizer links, which are important components that support the basic car functions of driving, turning, and stopping. The Group companies THK RHYTHM and TRA (THK RHYTHM AUTOMOTIVE) propose, manufacture, and sell these products to component manufacturers and our primary customers: automotive and truck manufacturers in Japan, North America, Europe, China, and other parts of Asia. In addition, our suspension links, ball joints, and tie rod ends are classified as critical safety parts. See the figure below for the mechanisms our parts are used in. - AMC (Automotive Mechanical Components)

This business segment develops, manufactures, and sells ball screws for automatic brakes and electric parking brakes, active suspension units, and other parts that are essential to self-driving technology. - Electric Actuator Development

We develop modules that are incorporated directly into automobiles to improve the riding experience and safety performance as self-driving cars become more prevalent.

One thing that all our divisions share is our intent to provide a variety of products and refine our technology to meet the requirements demanded by the market.

Accomplishing Our 2026 Fiscal Year Management Targets (Reflection on 2023 and Initiatives for 2024)

In order for the automotive and transportation business to achieve our 2026 management targets, we will take measures such as strengthening our existing products and expanding new, next-generation products to achieve a higher growth rate than that of the automotive market, aiming for a revenue of ¥135 billion and an operating income of ¥8 billion.

Automotive production and sales rebounded in 2023 with the end of the coronavirus pandemic and the easing of component shortages. At the same time, our cost reduction efforts such as activities to pass on price increases, production restructuring, and staffing reductions, as well as the weakness of the Japanese yen, enabled the automotive and transportation business to turn a profit for the fiscal year, with a revenue of ¥134.4 billion and an operating income of ¥1.6 billion overall. With sales projected to increase as a result of our main customers’ plans to increase production in 2024, we are promoting production restructuring and cost reduction initiatives to improve our profitability and spur

profit growth.

Future Initiatives: Working to Achieve a Sustainable Society

Cars are currently required to be safe and environmentally friendly modes of transport, and I believe it is our role to propose and provide a stable supply of products that will achieve that aim. With respect to being environmentally friendly, we continue to comply with environmental and fuel efficiency regulations and, as the EV transition continues and lightweight aluminum parts are increasingly utilized in North America by both regional manufacturers and Japanese ones transitioning to local procurement, we are promoting the development of linkage and suspension parts tailored for use in electric vehicles. As for safety, we believe that greater safety can be ensured by providing electric actuators

and other products with high added value that adopt THK’s core technology. The new ball screws that we began developing, manufacturing,

and selling for automotive applications have become essential products for CASE*-related self-driving technology, where they have been adopted for use in automatic and integrated brakes. We have also now begun shipping these products for use in next-generation suspension mechanisms. Going forward, we intend to expand sales in new sectors with ball screws and other products for eAxles and new braking systems.

Our working EV prototype, the LSR-05, made its world debut at the 2023 Japan Mobility Show. Equipped with cutting-edge adaptations of THK’s linear motion technology, it embodies what we envision automotive technology to be in the future as CASE continues to progress in the automotive industry.

We will look ahead five to ten years in the future and anticipate needs customers might not be aware of yet, utilize the expertise and technology THK has accumulated since its founding as a company focused on creation and development, and develop new products that meet future societal needs for self-driving technology and reducing automobile accidents involving aging drivers. In doing so, we aim to achieve the creation of a sustainable society.

* CASE stands for Connected, Autonomous, Shared & Services, and Electric.