Corporate Governance and Tax Matters

Basic Stance

Intending to maximize our corporate value, we strive to maintain solid corporate governance in order to make medium- to long-term improvements to our corporate value by sustaining growth through appropriate cooperation with all our shareholders and other stakeholders.

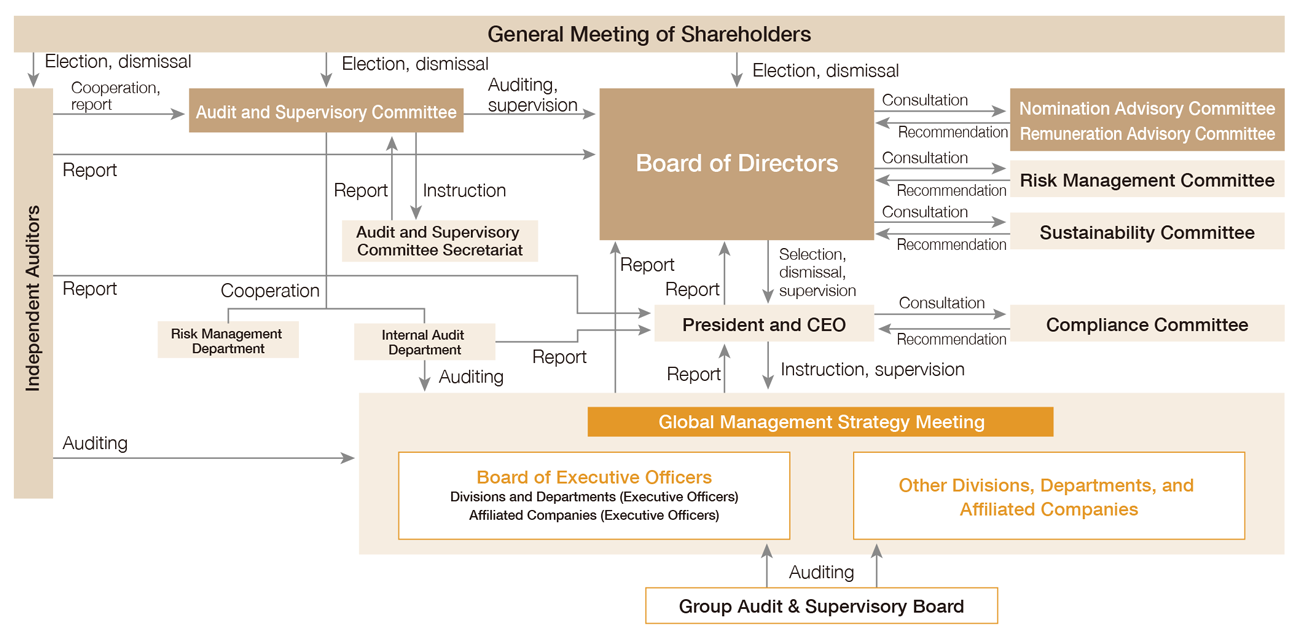

Governance Structure

For our institutional design, in conjunction with our establishment of an Audit and Supervisory Committee, we also instituted a non-mandatory Nominee Advisory Committee and a Remuneration Advisory Committee, with half of the members of both committees being outside directors to ensure further transparency and fairness in management personnel and remuneration.

We have also introduced an executive officer system. In doing so, we have strengthened the auditing functions of the Board of Directors in addition to bringing greater speed and efficiency to management-related decision-making and the management of corporate affairs.

Tax Matters

Basic Policy

The THK Group appropriately files tax returns and pays taxes in accordance with both international tax regulations and the laws of each country and region in which it does business.

Tax Risks

In addition to closely reviewing any transaction that may incur tax risks, we handle such matters appropriately by seeking advice from outside experts and consulting with the relevant tax authorities. Furthermore, we seek to control tax risks by utilizing advance pricing agreements (APA).

Our Relationship with Tax Authorities

The THK Group strives to maintain a relationship of trust with tax authorities by disclosing required information in good faith.

Ensuring Transparency

The THK Group appropriately discloses information in accordance with each country's laws and disclosure standards. Furthermore, we submit a Master File as well as a Country-by-Country Report in accordance with Japanese tax rules.

Efforts at Each Facility

THK America

Sales Tax Audit

A sales tax audit was performed by California’s Franchise Tax Board in September, and no nonconformities were found.

Board of Directors

THK's Board of Directors comprises a total of nine directors-including two outside directors-who are not members of the Audit and Supervisory Committee, in addition to three outside directors who are Audit and Supervisory Committee members. The Board of Directors makes decisions on important matters of general management and carries out the oversight of directors and executive officers in the execution of their duties. There are also five outside directors whose independence meets the evaluation criteria stipulated by the Tokyo Stock Exchange and THK. With over a third of the directors being outside directors who possess specialized professional knowledge and qualifications related to corporate accounting or general management, this structure has further enhanced management neutrality, legality, and validity while improving the board's management oversight function.

Board of Directors and Executive OfficerSkill Matrix

| Corporate management | Finance and accounting | Governance and risk management | Global business | Sales and marketing | DX and IT | Development, engineering, and manufacturing | |

|---|---|---|---|---|---|---|---|

| Akihiro Teramachi | |||||||

| Takashi Teramachi | |||||||

| Hiroshi Imano | |||||||

| Toshihiro Teramachi | |||||||

| Nobuyuki Maki | |||||||

| Junji Shimomaki | |||||||

| Kenji Nakane | |||||||

| Masaaki Kainosho | |||||||

| Junko Kai | |||||||

| Masakatsu Hioki | |||||||

| Tomitoshi Omura | |||||||

| Yoshiki Ueda |