Business Strategy

Reflecting on the 2024 Fiscal Year

The industrial machinery business saw revenue and profit both dip in 2024 compared to 2023, with revenue down 0.4% at

¥216.6 billion and operating income down 24.2% at ¥16.8 billion. This was in part due to the large volume of orders on the books in the first half of 2023, which offset the modest recovery of demand we saw in 2024. While demand related to semiconductor manufacturing equipment continued its upward trend from 2023, riding a wave of investments spurred by the continued spread of AI, investments in manufacturing equipment for the general-purpose memory used in smartphones and PCs were slower to return, resulting in lower demand than what was forecast at the beginning of the year. Even in the Chinese market, where the first half of the year saw steady orders and revenue buoyed by grants and other economic stimulus measures from the Chinese government, demand was sluggish in the second half.

Our operating income was reduced both by the volume effect that accompanied our reduced revenue and our proactive investments in equipment and personnel made in anticipation of future growth in demand. Both revenue and operating income, however, exceeded our revised forecasts for November 2024.

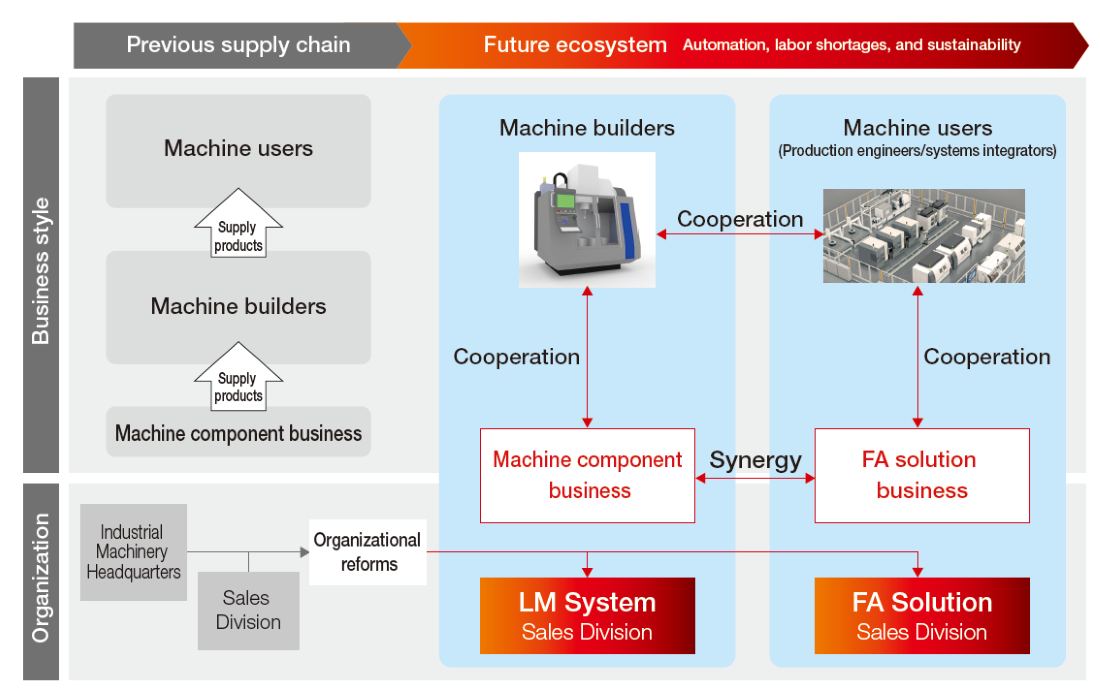

Though the machine component business has not seen demand return as strongly as expected, for development and sales departments, our proactive approach to breaking into new markets has yielded new customers and new development proposals, which indicates a positive outlook for the future. In addition, the sales division itself was restructured in April 2024 with the consolidation of the FA solution business, which brings together previously disparate FA solution resources to focus on creating more technologically advanced sales approaches in pursuit of greater growth. This has actually led to increased revenue from new products like  .

.

For our production departments, we continued to actively dedicate resources to the automation of our production lines. Going forward, in keeping with the structural reforms announced in February 2025, we will be creating even more advanced line automation. Looking ahead, where previously we focused on building up capacity to meet predicted growth in demand, we are now working to achieve the true goals of automation: bolstering cost competitiveness and increasing sales and profit per person. That is why we aim to achieve a lean business structure that weaves production equipment, robots, and human knowledge together organically to generate and maintain a high degree of profitability.

Aligning Strategy and Action with the New Management Policy

Traditionally, the industrial machinery business has seen profitability grow as a result of the volume effect of increased revenue driven by the twin growth strategies of full-scale globalization and the development of new business areas. However, in the face of massive fluctuations in demand during extreme booms and busts, the likes of which we first saw from 2017 to 2018 and from 2021 to 2022, we have prioritized the ability to respond quickly and preemptively bolstered production capacity, because it takes about two years for production to start after making the decision to ramp up. In the last couple of years, however, the global economy segmented into trade blocs, emerging countries took the fore as areas of demand, and areas of production went from being centralized to being scattered.

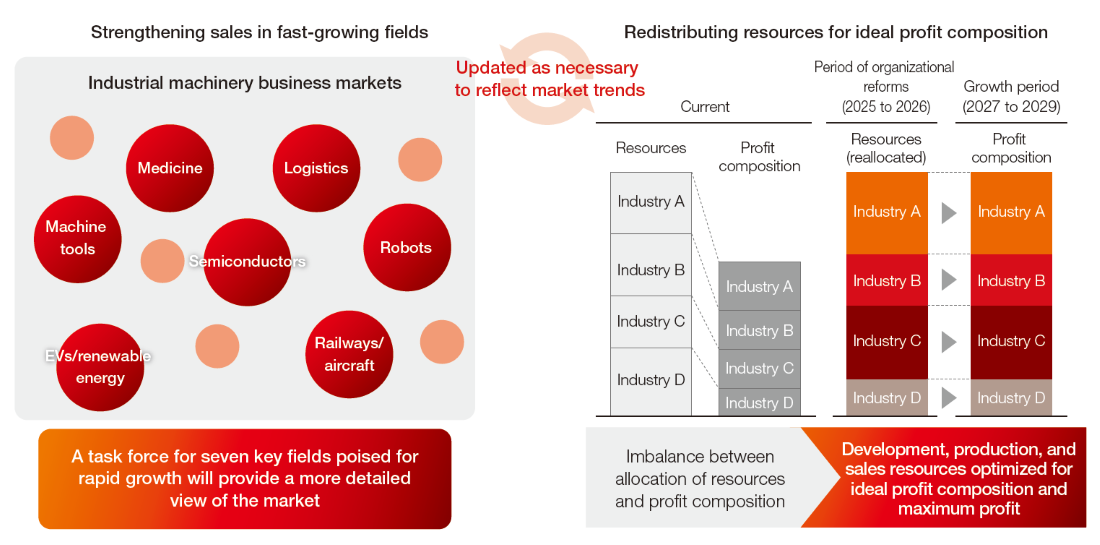

Demand started coming in disparate waves from individual regions rather than all at once. To reach an operating income above ¥40 billion for the sake of achieving an ROE greater than 10% as quickly as possible in this environment, we will make the most of the tangible and intangible assets we’ve invested in to both meet customer needs and improve profitability.

In concrete terms, as part of structural reforms launching in 2025, we will reduce fixed costs by optimizing our production structure and reaping efficiency gains provided by implementing new IT systems. This alone will secure close to ¥6 billion in profit. We will also improve our variable cost ratio by optimizing the price we pay for materials and parts and the price we charge for our products, netting an additional ¥14.4 billion. As we execute our strategy, we will rigorously monitor results, implementing further actions where these fall short as part of a PDCA cycle that will increase our effectiveness and transform us into a leaner business.

In light of the changing shape of the industry, the machine component business will bolster sales of the LM Guide and other products in seven key fields expected to grow on the global market. We will maximize profits in these fields by more accurately analyzing the needs and growth potential of each and by optimizing our development, production, and sales resources to achieve the right profit composition.

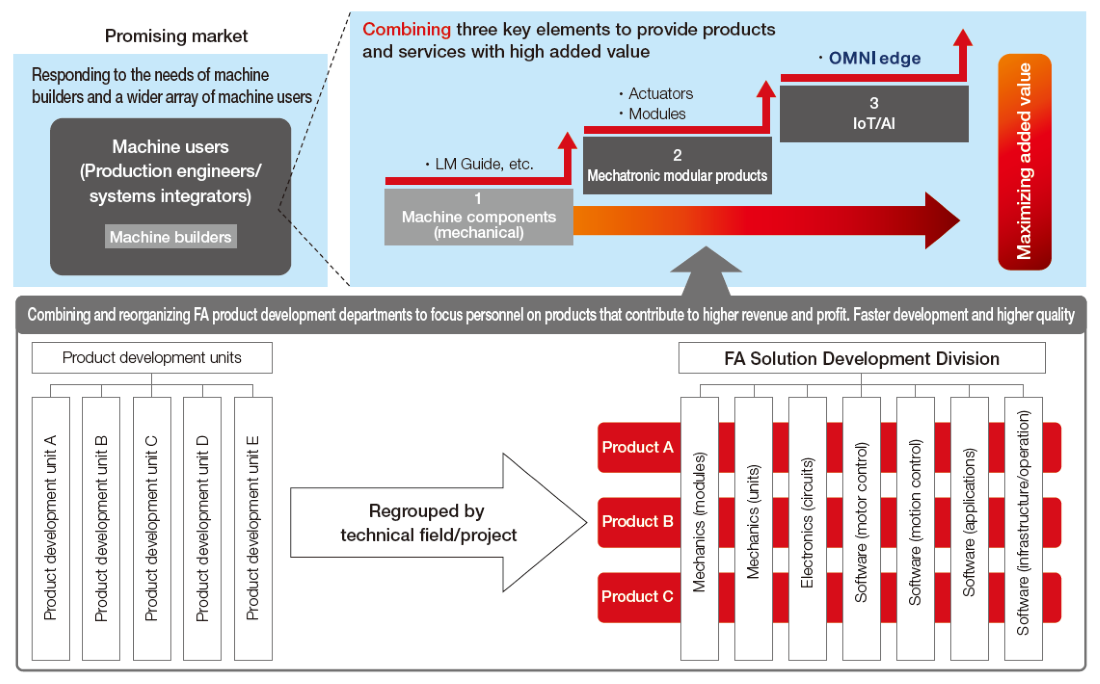

The FA solution business, on the other hand, is focused on helping both machine builders and a wide array of machine users overcome challenges in the context of production floors made ever more complex by social issues like automation, labor shortages, and sustainability. In 2025, we are reinforcing this business by reorganizing personnel from FA product development and other areas into groups based on their technical fields and the projects they are participating in as a way to further enhance the added value of our products and solutions. We will also leverage the wealth of data we have collected from the production floor to continually develop and release new problem solving solutions for our customers through the

platform. These efforts will allow us to increase our ¥30 billion revenue from 2024 by a factor of 1.5 to ¥45 billion or more by 2029 with our mechatronic module offerings and our IoT and AI solutions. Ultimately, we will transform into a manufacturing and innovative services company by structuring our business around supplementary services incorporated into a release cycle for new products and solutions that reflect the current challenges and potential needs of customers.

platform. These efforts will allow us to increase our ¥30 billion revenue from 2024 by a factor of 1.5 to ¥45 billion or more by 2029 with our mechatronic module offerings and our IoT and AI solutions. Ultimately, we will transform into a manufacturing and innovative services company by structuring our business around supplementary services incorporated into a release cycle for new products and solutions that reflect the current challenges and potential needs of customers.

If we are to achieve these goals, it is important that everyone is moving in the same direction, from the management level to the members keeping things running on the production floor. To this end, President Teramachi has made time to visit our main locations around the world in person to explain the aims and activities associated with our new management policy. As we create mechanisms to encourage employees to change their perspectives and behavior, we are also considering incorporating a structure for objective evaluations of changes in employee behavior into our personnel system. By aligning employee perspectives and company structures, we will create synergies that will assist in transforming our business.

A Look Back at 2024 and a Preview of the Future

The automotive and transportation business makes a variety of components needed for self-driving technologies, such as linkage and suspension (L&S) components and ball screws for automatic braking systems that utilize our core linear motion technology.

We came in strong in the first half of fiscal year 2024 due to a recovery from component shortages in the automotive industry, but as production and sales of vehicles softened throughout the latter half of the year, and in part as a result of a decline in the value of the yen, while revenue came in at ¥136.1 billion (a 1.3% increase year-on-year), our operating income was

¥600 million (a 64.5% decrease year-on-year), resulting in reduced revenue despite our staying in the black.

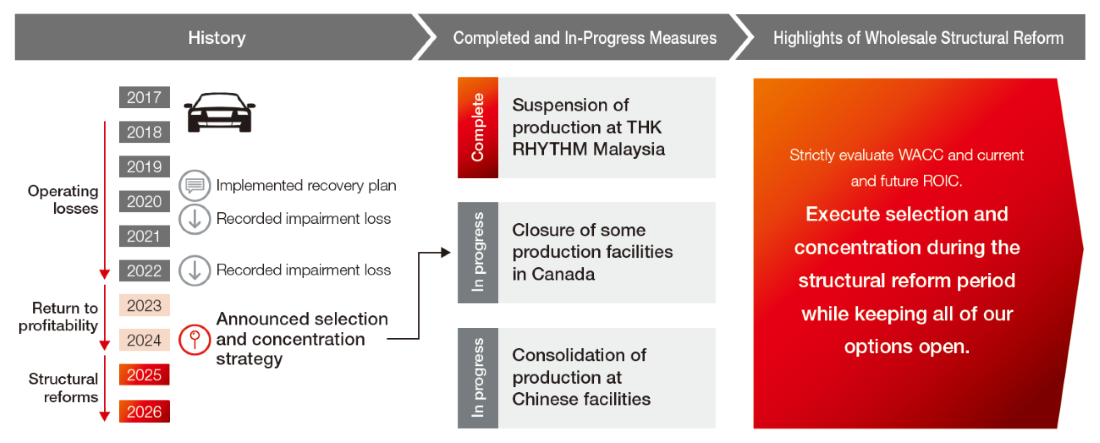

Looking back at recent history, the years between 2018 and 2022 were marked by ongoing operating losses, in the midst of which we experienced impairment loss twice. These circumstances prompted us to establish a recovery plan and drive efforts to improve profitability, which enabled us to turn a profit in the 2023 fiscal year. However, our return on invested capital (ROIC) still did not exceed our weighted average cost of capital (WACC), which further eroded the confidence of our investors and shareholders. We believe this is less the result of external factors such as drastic changes in the automotive industry and disruptions caused by the coronavirus pandemic, and more the result of internal ones, such as our not implementing radical countermeasures to improve profitability as these changes were occurring.

In light of all these factors, in addition to our new management policy to achieve an ROE greater than 10% as quickly as possible, we have decided to closely examine our WACC and our current and future ROIC in the automotive and transportation business to drive selection and concentration. In addition to the December 2024 decision to close the THK RHYTHM Malaysia plant, we have also decided to close a portion of our Canadian production facilities. We are also currently consolidating production at our facilities in China. Throughout this period of structural reform, we will achieve a completely new level of selection and concentration while keeping all of our options open in order to meet the expectations of all our shareholders and investors.