Message from the President

Thoroughly Strengthen What Needs to Be Strengthened and

Bravely Change What Needs to Be Changed

Year One: Engaging Earnestly with Stakeholders and Actively Exchanging Opinions

Over a year has passed since I, Takashi Teramachi, assumed the role of President in January

2024 in order to strengthen our management structure for the next generation. Looking back,

it was a year of trial and error as I did my best to fulfill my duty as COO, a position previously

held by Chairman Akihiro Teramachi (the former president). I’m still learning much from him

about how to look at things from a global perspective and gain foresight.

When I assumed the role of President, I announced my policy of thoroughly strengthening

what needs to be strengthened and bravely changing what needs to be changed even as we

hold on to what makes us THK. Our spirit as a company is encapsulated in our corporate

philosophy of providing innovative products to the world and generating new trends to

contribute to the creation of an affluent society. Employees of all ages in every department

have accomplished great things in their effort to make this philosophy a reality by engaging

with a new manufacturing paradigm. If we continue to adapt to changes in the industry and

every individual obtains new knowledge and has the courage to change what needs to be

changed, I firmly believe that THK will continue to be a company that is indispensable to the

world.

In the little over a year I have served as President, I have actively sought out opportunities

to exchange opinions with our shareholders, investors, customers, employees, and suppliers. I

aim to engage in those conversations in the same spirit of earnestness I had when I first joined

THK. I have also been mindful of ensuring information transparency in order to accurately

convey how various systems are operating and what our organization is working on. This

earnestness and transparency, I believe, are critical for building and maintaining trust with

stakeholders.

Shifting Gears toward Efficiency-Focused Management

Looking at the environment surrounding us, we are faced with numerous challenges such as

the advancement of digital technology, growing momentum for protecting the earth’s

environment, and declining working-age populations in developed countries. At the same

time, our growth potential is expanding thanks to a heightened need for the various solutions

to these challenges we offer alongside increasing demand for semiconductors, automation,

and robotization. Under these circumstances, we established our 2026 management targets

in February 2022 and made active upfront investments in our industrial machinery business,

based on an assumed 7% average market growth rate, while focusing on first achieving and

then increasing profit in our automotive and transportation business in light of shrinking

profitability.

However, the business environment has completely transformed since then under an

atmosphere of increasing uncertainty fueled by the rise of geopolitical risks, inflation, and the

slowdown of the Chinese economy. In more concrete terms, up to this point, we were used to

seeing major and repeated fluctuations in demand under the global economic system. In

response, our approach was to build up a framework that could flexibly handle the next peak

in demand that we anticipated would suddenly rush in. Now, though, thanks to the rapid

segmentation of the global economy into trade blocs, a shift in demand toward emerging

nations, and the dispersal of once-concentrated areas of production that has taken place over

the past one to two years, demand is no longer surging in one global wave. It has become a

combination of large peaks happening randomly throughout several regions and industries.

Therefore, rather than waiting for one large peak to come to us, we now need to shift our

posture to go out and seize the waves happening in all directions.

Under these circumstances, we determined that it would be difficult to achieve our

previous management targets, as the investments that we had made ahead of time, knowing

that bringing new machines fully online would lag about two years behind deciding to install

them, were putting pressure on our profits. Furthermore, as our return on equity (ROE)

stagnated, we continued to be in a situation where we were unable to meet the expectations

of our shareholders. Based on these factors, I felt that we needed to shift gears to focus more

on efficiency in our operations.

Therefore, in November 2024, we announced our new basic policy of achieving an ROE

greater than 10% as quickly as possible, as that amount will exceed our shareholder’s equity

costs. In February 2025, we then announced our course of action to achieve that goal. We

have set forth multifarious challenges for our business involving our profitability, capitalization

strategies, and corporate governance to work toward this goal. In terms of profitability, we will

resolutely carry out structural reform, holding nothing sacred, and transform into a lean

business. We will achieve our target primarily under our own power, without relying on

increases in demand to boost our operating income. In addition, we will expand over the

medium to long term by making highly disciplined investments in the growing fields of the

future.

There are three keys to achieving our new management target. The first is human capital.

We have been around for over half a century, and during that time, a number of incidents have

occurred that rocked the industry or general society. The thing that has allowed us to weather

those storms has been the power of our people. I am proud of how we have engaged with

our customers’ struggles as needed and generated new trends as a company focused on

creation and development. That is why I have faith that our employees will work together to

overcome even the challenging business environment we are currently facing. The other thing

our people excel at is their willingness to sincerely accept the reasoning behind and goals of

this structural reform and change their own mindset and behaviors, which is thanks to their

high level of trust in the company and desire to contribute. As we work to achieve an ROE

greater than 10%, we are also introducing an employee stock ownership system and bonuses

linked to consolidated operating income.

The second key is the competitive advantage of our products and services. We are the

pioneers of the LM Guide produced by our industrial machinery business, and we hold the top

global market share. The superiority of our products is bolstered by our integrated sales and

production structure, in which we handle our own sales and production activities in various

locales. We built up our supply chain with the primary aim of being able to swiftly prepare

ourselves for the next peak in demand, but as the world's economy becomes more

segmented and demand shifts toward emerging nations, we need to rebuild our framework

and reduce our fixed and variable costs through cumulative, detailed measures at the facility

level. As we execute our strategy, we will rigorously monitor results, implementing further

actions where these fall short as part of a PDCA cycle that will increase our effectiveness and

transform us into a leaner business. Furthermore, we will strengthen our structures and

mechanisms for obtaining a clear and direct picture of what our customers’ needs are in each

region and pass that information on to our engineering and development divisions for the sake

of developing new products and solutions. Our ability to successfully execute this cycle is

indispensable to maintaining our competitive advantage.

Finally, the third key is our capitalization strategies. As I touched on earlier, we are working

on increasing our profitability even as we seek to control our equity, which is the denominator

of our ROE. We will continue to execute strategies such as our policy of adopting a dividend

on equity ratio (DOE) of 8% until we achieve an ROE greater than 10%. Between December

2024 and March 2025, we purchased ¥40 billion of treasury stocks, and we will continue to

consider the agile acquisition of more in light of our progress toward our target.

Promoting a Strategy Based on the Characteristics of Our Main Markets, Including the Americas, Europe, and China

I would like to give an overview of our market strategies for each region. The Americas are continuing their momentum as the global center of high-tech revolution. We can continue to anticipate growth in this market, where opportunities present themselves from the new demand accompanying developments in cutting-edge semiconductor manufacturing machines, aerospace, and humanoid robots as well as investments in automation throughout the automotive, medical, logistics, and other fields. We will meticulously address the unique needs of each customer there.

In Europe, Germany may be struggling currently, but we are receiving more inquiries driven by the shift of production away from there into Eastern Europe in addition to the automation needs of distribution centers in Southern Europe. Going forward, we will launch our own e-commerce from Germany and collaborate with our distributors to capture an even broader portion of the region's demand.

China, as always, continues to be a key region with an extremely large market. Recently, demand for replacing consumer products and machinery has arisen, which has caused an upward trend in orders.

In other Asian countries, demand has been increasing as production operations move into that region. India, in particular, has the world’s highest population and is an attractive area for manufacturing that holds an important position in the global supply chain, so we have been focusing our efforts there.

The manufacturing industry in Japan, in contrast, is struggling with labor shortages. Now is the time for companies to automate, and that presents an opportunity for us. Naturally, we ourselves will continue to actively pursue automation at all of our production facilities.

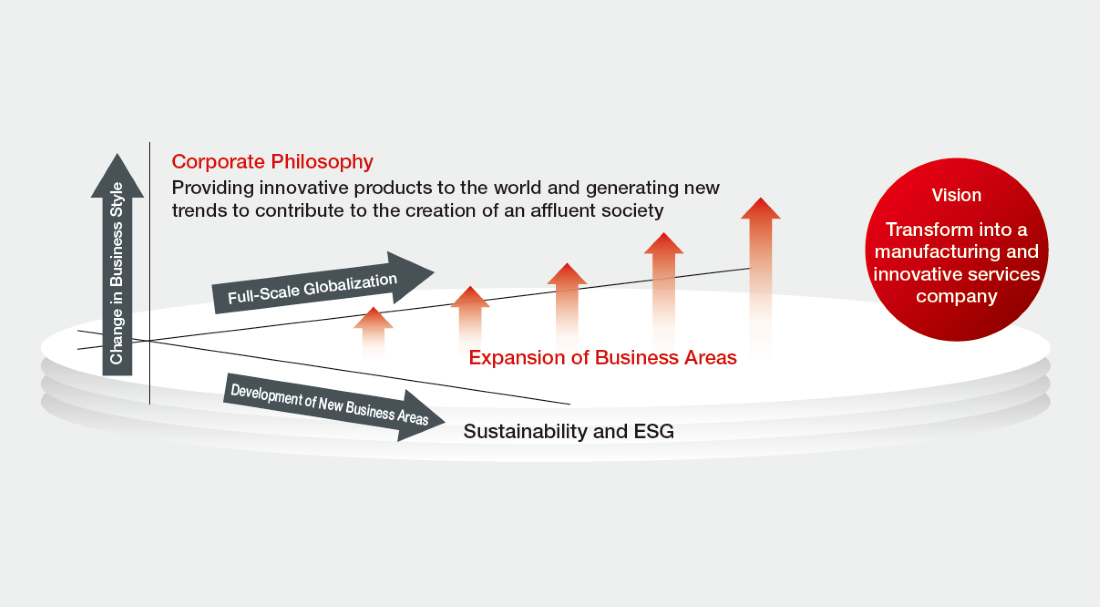

Creating a Peerless Business as a Manufacturing and Innovative Services Company

I feel that the challenges facing our customers have been evolving and diversifying over the past decade. They span everything from digitalization and environmental regulations to labor shortages. In the midst of these changes, THK must continue to make itself indispensable. That is why, in 2022, we established our vision to transform into a manufacturing and innovative services company.

Even before then, we had a history of applying our primary expertise in linear motion not only to traditional fields, but to new ones such as medical devices and railways. However, our business was still focused on physical goods. Since the late 2010s, though, it became possible to remotely monitor equipment through the IoT, and our business was no longer constrained by the need for physical objects. We made it possible to visualize the operational status of equipment, which then enabled us to provide services that utilize that data. In the future, we will leverage both our physical manufacturing and the digital services we offer to adapt to the changing needs of our customers.

Our vision includes advancing the manufacturing and linear motion technology that constitute our principal business. For instance, our

IoT service, which helps maximize OEE (overall equipment effectiveness) by monitoring the status of components, is aimed at not only machine builders, but an even broader spectrum of machine users.

IoT service, which helps maximize OEE (overall equipment effectiveness) by monitoring the status of components, is aimed at not only machine builders, but an even broader spectrum of machine users.

Optimizing the timing of replacing components by predicting when they will fail has the primary benefit of minimizing opportunity losses for our customers. Secondary benefits we foresee include the ability to accommodate labor shortages in maintenance and decrease resource consumption and greenhouse gas emissions by reducing defects. We will continue to develop application services that help resolve the societal challenges that our customers face. Already, more direct interactions with machine users are revealing new needs for machine components and actuators, prompting a number of product development projects.

Our LM Guide and other machine component business is the bedrock of our company. I regret that we were not able to completely fulfill our responsibility to meet growing demand in the face of the drastically fluctuating global economic cycles of the past 10 years. This was the reason we prioritized cultivating the agility to adapt to fluctuating demand and increasing revenue, actively making advance investments in equipment and building a supply chain suited to the demand volume. However, as the global economy has been segmenting into distinct trade blocs over the past one to two years and the timing of demand for machine components has varied by region, we will now shift toward a manufacturing structure that allows us to optimize the equipment and supply chain we have already invested in and satisfy the needs of our customers while at the same time boosting our profitability. We will also focus our efforts on high-growth industries, emerging fields, and the development of new applications to expand our machine component business. Furthermore, we will soundly launch our FA (factory automation) solution business to respond to the expected growth in demand for control and other mechatronic modules and IoT/AI services in this new era of automation, AI, the IoT, and robotics. In addition, we will create further synergy between our machine component and FA solution businesses to develop THK-exclusive lines of business that no other companies can equal.

At the same time, as the ROIC (return on invested capital) of our automotive and transportation business remains below our capital expenses, our shareholders and investors have been asking us to elect a course of action with clear deadlines. To meet their expectations, we will conclude a process of selection and concentration to an unprecedented degree by the end of our structural reform period in 2026.

Developing Next-Generation Talent and Driving THK’s Evolution through Individual Growth

Up to this point, I have primarily explained how we will focus our management on profitability and capital efficiency to achieve an ROE greater than 10% as quickly as possible, but over the medium to long term, we are also endeavoring to construct a foundation for sustainably growing our corporate value. At the core of this effort is the development of the next- generation talent who will inherit our manufacturing and innovative services company.

To strengthen our human capital, we have been working to cultivate global and digital talent, expand training and other development opportunities, promote diversity, and improve work-life balance. Furthermore, in thinking about coexistence with AI, I believe that “talent of the heart” will be critical. This is a concept that Masayo Imura, a Japanese artistic swimming coach, has referenced in speeches, and it is one that both our Chairman and our organization hold dear. It refers to the ability to avoid limiting yourself, to believe in your potential, and to accept things with a positive, honest attitude without blaming other people or the environment. To enable our employees to grow on their own through this talent of the heart, we are giving them more opportunities to gain diverse experiences, discover their hidden potential, and actively learn new things. I hope that, through individual growth, we can achieve an evolution of our entire organization.

Our society 20 to 30 years from now will likely be one in which AI and robots coexist with humans, learning and acting on their own. As a manufacturing and innovative services company, THK will skillfully employ such technologies as they progress, even as we strive to be a company where people seize initiative and continue to work on solutions for customers’ problems.

With an initial target of achieving an ROE greater than 10% as quickly as possible, as outlined in our new management policy, we will construct a foundation for sustainably increasing our corporate value. Please look forward to even greater things from THK.