New Management Policy: Achieve an ROE Greater than 10% as Quickly as Possible

Thoroughly Strengthen What Needs to Be Strengthened and Bravely Change What Needs to Be Changed

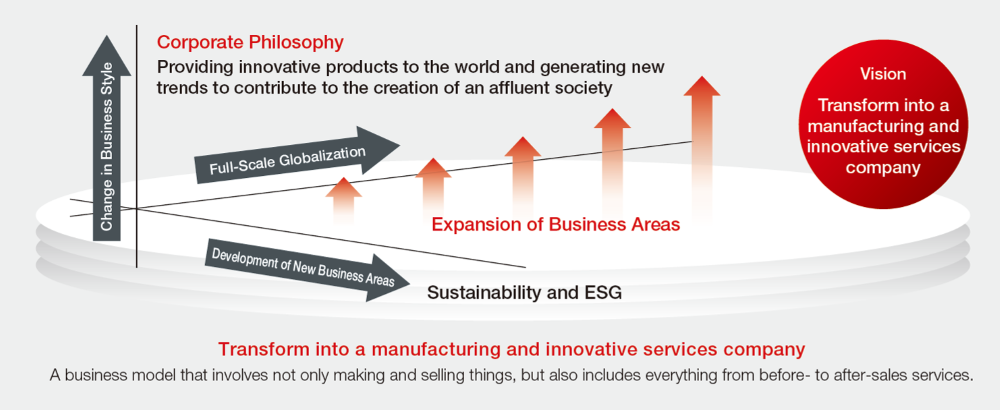

Corporate Philosophy and Vision

THK's corporate philosophy is providing innovative products to the world and generating new trends to contribute to the creation of an affluent society. According to this philosophy, THK exists for the purpose of contributing to the creation of a more affluent society by providing products and solutions that solve society’s problems. As we hold to our vision of transforming into a manufacturing and innovative services company in order to fulfill this purpose, we are working to further expand our business domains through our growth strategies of full-scale globalization, the development of new business areas, and a change in business style. At the same time, we continue to strengthen our sustainability and ESG activities as well.

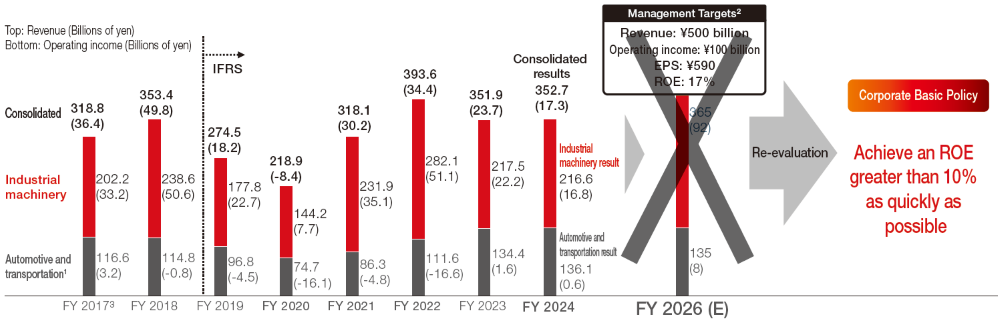

Reflecting on THK’s 2026 Management Targets (the Five-Year Plan)

The current environment of escalating geopolitical risks, ongoing inflation, a slowing Chinese economy, and a major revolution in the automotive industry is drastically different from the one in which we set our original management targets to serve as milestones in our transformation into a manufacturing and innovative services company. In this context, these targets were in need of revision. For one, THK was unable to respond to the changes in our environment quickly and sufficiently, making it very difficult to achieve these targets. Additionally, our low return on equity (ROE) meant we still were not meeting shareholder expectations. These factors demanded a shift toward efficiencybased management with a new management policy of achieving an ROE greater than 10% as quickly as possible and various measures for doing so.

*1 The numbers for the automotive and transportation business are the combined values from THK RHYTHM and TRA.

*2 Set in February 2022.

*3 The results for the 2017 fiscal year reflect reference values from a modified reporting period from January to December.

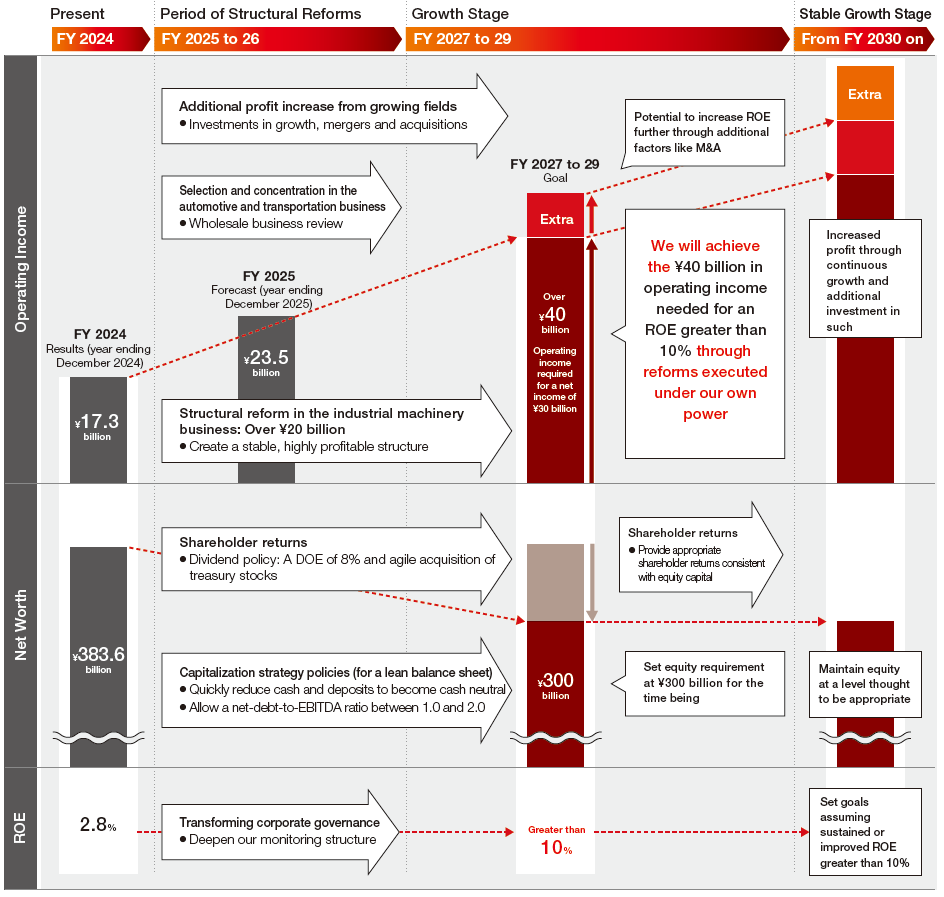

Roadmap for an ROE Greater than 10%

In terms of business metrics, our goal is to secure the ¥40 billion in operating income we need to reach ¥30 billion in net income (the numerator of the ROE equation) and to have ¥300 billion in equity (the denominator). To promote management that emphasizes profitability and capital efficiency in order to achieve these targets, we will employ a strategy of selection and concentration based on capital costs, make highly disciplined investments to bolster competitiveness for the sake of sustainable growth, and review our capitalization strategies. We will also transform our corporate governance structure to further augment these efforts. Furthermore, we will achieve these targets primarily under our own power, without relying on market growth to increase sales revenue, by driving wholesale reform in both the industrial machinery and automotive and transportation businesses. Over the next two years, we will be driving structural reforms at all levels to become a lean, highly profitable business.Then, between 2027 and 2029, we will achieve an ROE greater than 10%.

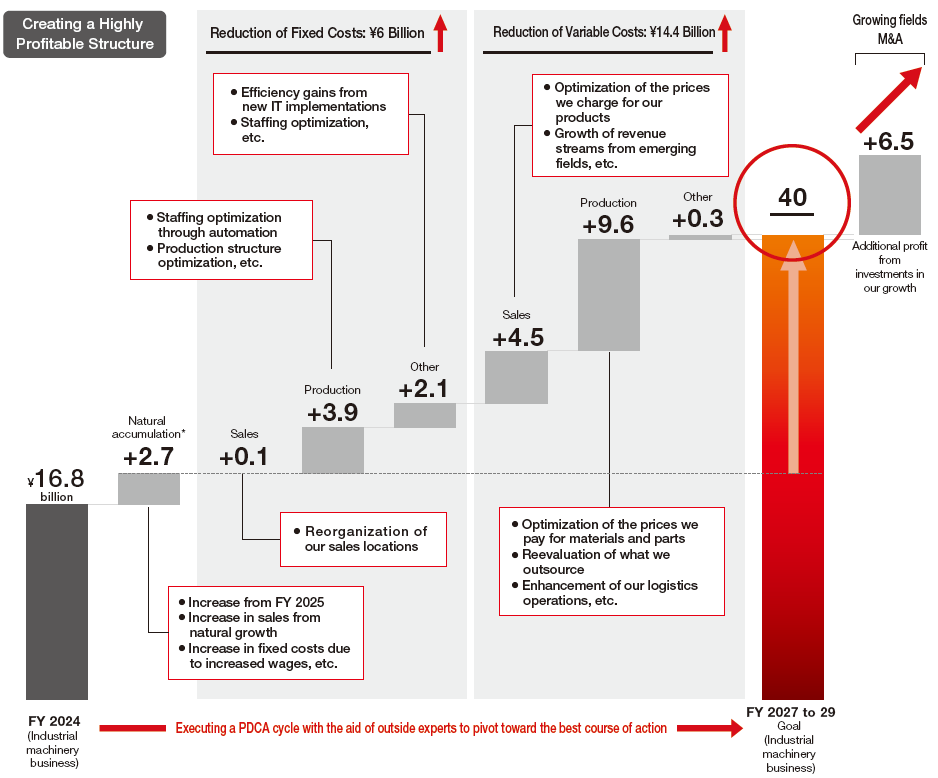

Achieving an Operating Income of Over ¥40 Billion

Rather than depend on increasing sales, we will achieve an operating income of over ¥40 billion through structural reforms to the industrial machinery business executed under our own power. First, we will assume a natural accumulation of ¥2.7 billion to result from a combination of our forecast results for 2025, forecast sales revenue for 2026 to 2029 that assumes an average growth rate of 2% per year, and projected labor costs assumed to increase by just over 4% per year. By reorganizing our sales locations, optimizing production staffing through automation, and optimizing our production structure overall, we will add a further ¥6 billion to this sum as a result of lower fixed costs. As we improve our variable cost ratio by optimizing the prices we charge for our products and the prices we pay for materials and parts, growing revenue streams from emerging fields, reevaluating what we outsource, and enhancing our logistics operations, we will secure a further ¥14.4 billion. Aided by outside expertise, we will execute our strategy using a PDCA cycle that includes rigorous validation and prompt incorporation of new measures to address anything found wanting. While these structural reforms in themselves will allow us to achieve an operating income of ¥40 billion, we will target growing fields and employ mergers and acquisitions to take us even higher. While the automotive and transportation business is pursuing an unprecedented level of selection and concentration during its own period of structural reform, profit trends for that part of our business will not be disclosed here.

* This natural accumulation value combines our forecast results for 2025, forecast sales revenue for 2026 to 2029 that assumes an average growth rate of 2% per year, and projected labor costs assumed to increase by just over 4% per year, on average.

Note: Values shown may be slightly different from actual sums due to rounding.

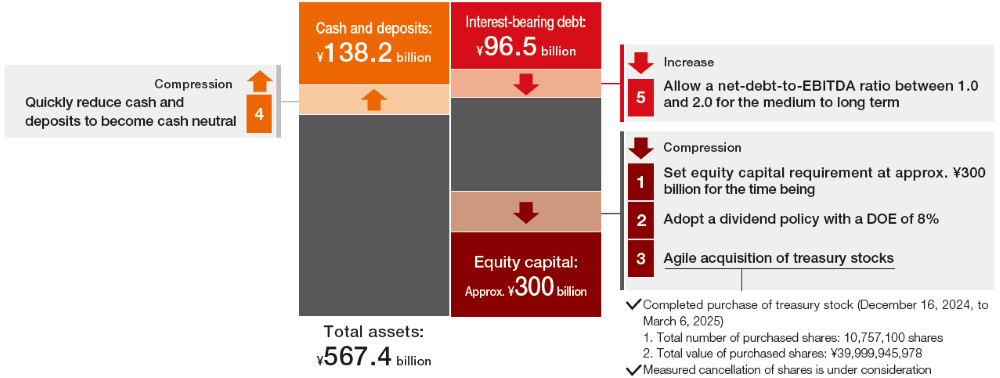

Balance Sheet Management That Emphasizes Capital Efficiency

In light of additional financial simulations confirming that we have built up sufficient internal reserves to fund future investments in our growth, that we currently do not need to add to these reserves further, and that enhancing our capital efficiency requires more proactively providing returns to our shareholders and a leaner approach to our balance sheets, we undertook a sweeping review of our capitalization strategies. As a result, it was resolved that we will continue to pursue policies 1 through 5 in the figure below until we have achieved an ROE greater than 10%.

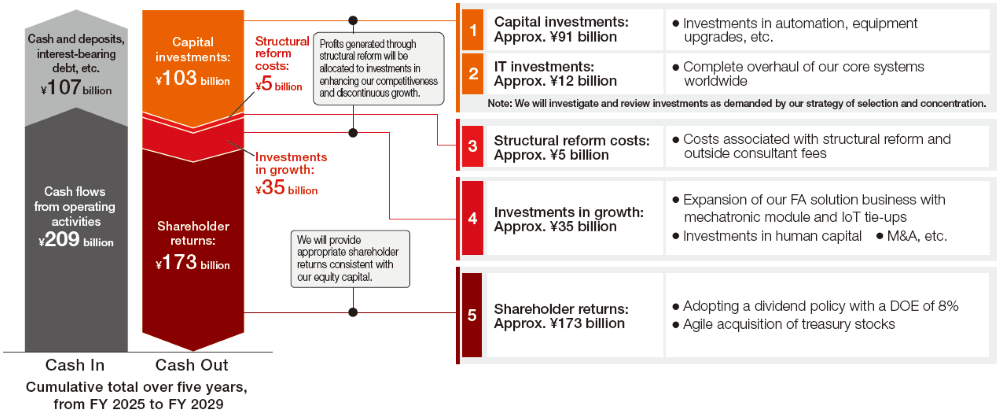

Capital Allocation

From now through the 2029 fiscal year, we will ensure returns for our shareholders by allocating ¥91 billion for automation and the most essential capital investments (primarily equipment upgrades), ¥12 billion for a complete overhaul of our core systems and other IT investments, ¥5 billion for structural reforms, and ¥35 billion for investments in our growth, including M&A to expand our FA solution business and investments in our human capital. The capital for these investments will come from converting cash flows from operating activities and funds for things like external procurement into capital in such a way that it maintains the financial health of our organization.

Beyond an ROE Greater than 10%

In these ways, we will not only achieve an ROE greater than 10% as quickly as possible, but push further to raise our ROE beyond our capital stock costs for the sake of increasing corporate value to ensure that we can continue to provide stable returns to our shareholders.